What is changing?

Retirees – Effective Jan. 1, 2020, all active retirees will be transitioning to a Health Reimbursement Account (HRA).

Active employees – Effective June 1, 2018, Harris Health is implementing a change to eligibility to post-retirement health benefits for active employees and new hires. Employees who begin work on or after June 1, 2018, will not be eligible for post-retirement healthcare benefits. Anyone in a full-time status as of June 1, 2018, will still be eligible for post-retirement healthcare benefits. All employees retiring after Jan. 1, 2020, will receive an HRA as their post-retirement health benefit.

What is an HRA?

An HRA is an IRS approved, employer funded tax advantaged account that provides reimbursement to employees to use on qualified expenses. The HRA account is funded entirely by Harris Health; you do not contribute any money to your HRA account. Each plan year, Harris Health will contribute a specified amount to each participant's HRA. As long as there is money in your account, you can use the funds toward eligible HRA expenses.

Are HRAs commonly used by other employers?

Yes. Many other Houston-area and Texas Medical Center employers have long been providing HRAs to employees and retirees.

Who can put money in my HRA?

According to IRS rules, HRAs are fully owned and funded by the employer, Harris Health System.

What are the benefits of an HRA?

Harris Health contributes funds to a special account to help you pay for healthcare expenses. Retirees will not pay taxes on the money they receive and use for qualified medical expenses.

You will be able to choose from a variety of health plans, at varying prices, available in the individual-plan market in your area. You and your spouse may even choose different plans.

You can re-evaluate your plan choice every year and work with a benefits adviser to change your plan if you need to.

How can I access/use the money deposited in that account?

HRA funds can be used to pay premiums for an individual health insurance policy, a Medicare Advantage policy and/or to cover eligible out-of-pocket medical expenses. The HRA account gives you flexibility to determine how you want to use your retiree health benefits. The following list provides a few examples of qualified HRA expenses.

Do unused dollars remain in my account from year to year?

Do unused dollars remain in my account from year to year?

Any unused Harris Health contributions remain available to you for future healthcare expenses. You do not have to use all of your healthcare dollars in any single plan year.

What is the difference between an HRA and an HSA?

An HRA is funded entirely by the employer, and an HSA can be funded by employees, retirees, employers or family members. An HSA is owned by the employee, while an HRA is owned by the employer.

What are the tax benefits of an HRA?

The money deposited in your HRA is not reported as income, so you are getting tax-free money to use for your medical needs.

Does the money in the HRA earn interest?

No. The HRA is a special spending account and does not earn interest.

How much will Harris Health put in my HRA?

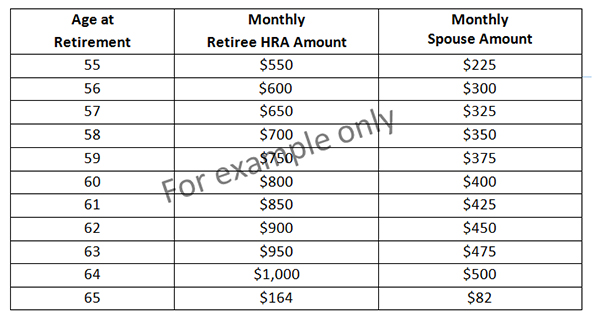

The specific dollar amount Harris Health will provide will not be determined until an HRA administrator has been selected. However, as a reference we have provided the illustrative example below to give you an idea on how much may be contributed to your retirement HRA. You must still meet the Rule of 80 (age + years of service = 80) or are considered grandfathered at retirement, to qualify for retiree healthcare.

Once an employee retires, their defined HRA dollar amount is “locked in,” until they reach age 65. At that time, the HRA amount changes to a contribution equal to Harris Health’s current Medicare-eligible retiree healthcare expense, which is approximately $164 per month or $1,967 per year. The above-referenced amounts are planned to be supported by an annual COLA* (cost-of-living adjustment) of approximately 3%.

*Please note that COLA does not apply to the pension plan benefit.

Will this affect my Pension/401(k) or 457(b) Plans?

This will not affect your pension/retirement benefit.

Who do I contact with questions?

You can call the Human Resources Benefits Department at 713-566-6451.

FAQ printable